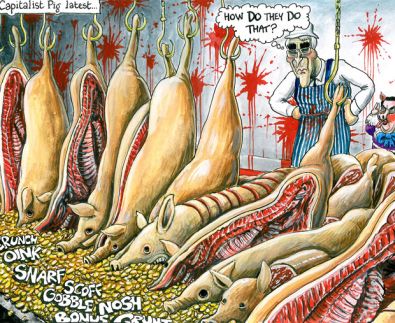

'CAPITALIST

PIGS: THE LATEST'

[Guardian

Unlimited, U.K.]

The China Daily, People's

Republic of China

China 'Will Not Tolerate' U.S. Exchange Rate Threats

Is a trade war about to brake out

between the United States and the People's Republic of China? U.S. talk of

Chinese currency manipulation has raised hackles in Beijing, and they have

responded. This article from China's strictly-controlled China Daily

might be summarized this way: "You [the U.S.] had better not start a trade

war - but if you do, America will be hurt more than China will." Or in the

words of Deng Yuwen, the author of this article:

"China and the United States are about to enter a trade war ... China will not tolerate American

intervention in its exchange rate policymaking, which is within the

jurisdiction of the nation's sovereignty. … As the largest American creditor,

China is estimated to hold 35.4 percent of all U.S. government bonds. Even now,

when its own economy is suffering severe hardship and a serious lack of

fluidity, China has chosen to refrain from selling U.S. national debt. …

the exclusion of Chinese products from the U.S. market wouldn’t severely impact the foundation of the Chinese economy, since the U.S. only accounts for 20 percent of the Chinese export volume. Meanwhile, China is trying to develop a more domestically-driven economy."

By Deng Yuwen*

February 6, 2009

People's

Republic of China - China Daily - Original Article (English)

Just as the world desperately

needs a concerted effort to tackle the escalating financial crisis, there is

growing concern within the international community that China and the United

States are about to enter a trade war.

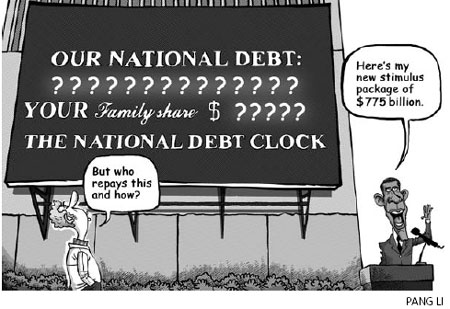

In a Congressional hearing

before he took office, U.S. Treasury Secretary Timothy Geithner accused China

of currency manipulation. To calm official and academic refutations from the

Chinese side, the White House later explained that its policy on China's

exchange rate is still being studied and yet to be confirmed.

But the tough stance by the

new U.S. Treasury chief, whatever motivated it, heralds a potential escalation

of long-standing economic frictions between the world's two economic

heavyweights.

Given President

Barack Obama's prior stance on China's exchange rate and the nearly unanimous

bipartisan consensus on the issue, the new American administration is likely to

launch a trade war to punish China. The extent of China's reaction will decide

the emerging magnitude of the trade dispute.

China will not tolerate

American intervention in its exchange rate policymaking, which is within the

jurisdiction of the nation's sovereignty. There is wide consensus among Chinese

decision makers that even a 40 percent revaluation of the yuan, a target long

sought by Washington, will not help solve the root cause of the China-U.S.

trade imbalance.

Due to its policy momentum

and the factor of population, chances are slim that China will, within a short

period of time, greatly increase the cost of its labor, land and other

resources.

[The

China Daily, People's Republic of China]

Comparatively cheap prices

have been the key to maintaining the sharp edge of Chinese products in an

increasingly fierce international market. And more importantly, the ballooning

trade deficit on the U.S. side is largely attributable to the asymmetrical

China-U.S. trade structure and a decades-long ban by the White House on the

export of hi-tech products and weapons to China. No major U.S. policy changes

are expected for the foreseeable future in this regard.

What Washington would like

China to do is to side with it in rebuilding the international financial and

economic order. Furthermore, the U.S. would like to ensure wider Chinese

financial openness to the outside world - especially since developing Asian

economies are expected to buy additional treasury bonds to support U.S.

economic revival.

China, however, cannot fully

meet these demands, which is why the possibility of a trade war between the two

nations can't be ruled out. The Obama Administration should be aware that at

the moment, no winner would emerge from a trade war with the world's largest

developing nation.

For China's part, such an economic war with the United

States would result in an export decline followed by the insolvency of some of

its export-dependent enterprises. The fact is that the Chinese exports have

already suffered a sharp decline since the second half of 2008.

For China's part, such an economic war with the United

States would result in an export decline followed by the insolvency of some of

its export-dependent enterprises. The fact is that the Chinese exports have

already suffered a sharp decline since the second half of 2008.

But from the point of view of

the United States, the situation is different. Without importing cheap,

good-quality Chinese goods, ordinary U.S. households, who have already suffered

terribly during the current crisis, will be plunged into an even harsher

predicament. At this point at least, no other nation can play the role China

does in the daily lives of ordinary Americans. If a trade war does brake out,

U.S. public opinion is expected to pressure decision makers in Washington to

reconsider their policies in favor of "made-in-China" products.

Furthermore, the exclusion of

Chinese products from the U.S. market wouldn’t severely impact the foundation

of the Chinese economy, since the U.S. only accounts for 20 percent of the

Chinese export volume. Meanwhile, China is trying to develop a more

domestically-driven economy.

As the largest

American creditor, China is estimated to hold 35.4 percent of all U.S.

government bonds. Even now, when its own economy is suffering severe hardship

and a serious lack of fluidity, China has chosen to refrain from selling U.S.

national debt.

This praiseworthy move by

China demonstrates its responsible attitude about further developing bilateral

ties and its aspiration to help stabilize the U.S. and global economies. It is

hoped that the Obama Administration will also resist taking any action that

could compromise the feelings of the Chinese people and their national

interests.

Posted by WORLDMEETS.US

In the long run, a trade war

with the United States could prompt China to develop an economy based not on

exports and investment, but on domestic consumption. Such an economic model

would change the level of Chinese dependence on foreign markets for economic

growth.

There is no doubt that a

Sino-U.S. trade war would further worsen the external economic environment for

China. But aggravating outside pressure is expected to contribute to the

nation's pursuit of an economic transition that will lead to a more rational

distribution of income and less of a need for the application of government

power on economic issues.

Trade is thought of as a reciprocal

state-to-state economic activity. With decades of bilateral economic exchanges,

China and the United States have set up an interdependent economic relationship

that requires cooperation on both sides.

*Associate editor-in-chief

of 'Study Times,' which is

affiliated with the Central Committee of the Communist Party's party school.

[Posted by WORLDMEETS.US

February 10, 8:41pm]